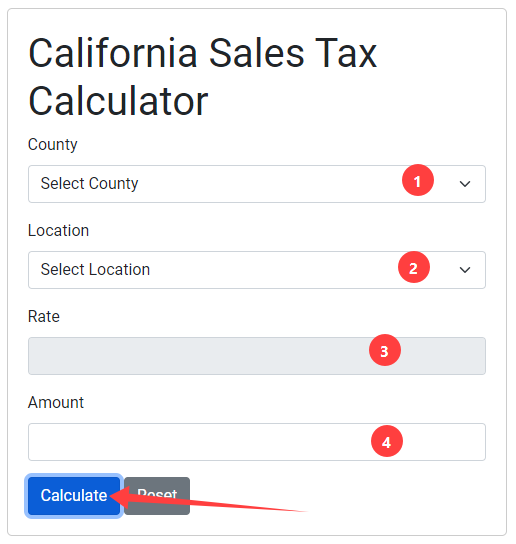

How to use Califonia Sales Tax Calculator

To use the California Sales Tax Calculator, follow these steps: Visit the website: California Sales Tax Calculator. Enter the purchase amount in the designated input field. Select the location or provide the necessary information about the location where the purchase is being made. Click on the "Calculate" button or any relevant button to initiate the calculation process. The calculator will process the information and display the sales tax amount you owe on your purchase in California.

Understanding and Calculating California Sales Tax

When conducting business or making purchases in California, it's essential to be aware of the state's sales tax requirements. Calculating the correct amount of sales tax can be complex, considering the varying rates across cities and counties. To simplify this process, you can utilize a California sales tax calculator, which helps you determine the appropriate amount to include in your transactions. In this article, we will explore the ins and outs of California sales tax, how to calculate it accurately, and the tools available to assist you.

What is California Sales Tax?

California sales tax is a consumption tax imposed on retail sales of tangible goods and some services within the state. The revenue generated from sales tax helps fund various public services and programs in California, such as infrastructure, education, and healthcare. The sales tax rate in California is composed of both state and local components, resulting in different rates depending on the location.

California Sales Tax Rate

The California sales tax rate consists of the state rate and local rates, which can vary across different cities and counties. As of the most recent update, the current statewide sales tax rate in California is [state sales tax rate]. However, it's important to note that local jurisdictions in California have the authority to add additional sales taxes on top of the state rate.

To find the exact sales tax rate for a specific location in California, you can use online resources, such as the California Sales and Use Tax Rate Finder provided by the California Department of Tax and Fee Administration. This tool allows you to search for the applicable sales tax rate by city or ZIP code.

Calculating California Sales Tax

Calculating California sales tax manually can be time-consuming, especially when dealing with multiple locations and rates. To simplify the process, you can use a California sales tax calculator. These online tools take into account the specific location and provide accurate calculations based on the applicable sales tax rate. By entering the sale amount or purchase price, the calculator instantly determines the sales tax amount to be included.

Using a California sales tax calculator ensures accuracy and helps you avoid potential errors or miscalculations. It also saves time and effort, allowing you to focus on other aspects of your business or personal transactions.

California Sales Tax Lookup

When you need to look up the sales tax rate for a specific location in California, various resources are available to assist you. In addition to the California Sales and Use Tax Rate Finder mentioned earlier, you can also check with your local county or city government websites, as they often provide information on sales tax rates specific to their jurisdictions.

California Sales Tax Exemption and Refund

Some transactions in California may be exempt from sales tax. Common examples include certain types of food, prescription medications, and sales to tax-exempt organizations. If you believe you qualify for a sales tax exemption, it's essential to review the guidelines provided by the California Department of Tax and Fee Administration or consult with a tax professional to ensure compliance.

In certain cases, you may be eligible for a sales tax refund. For example, if you were charged sales tax on an exempt transaction or overpaid the sales tax due to an error, you can file a claim for a refund with the California Department of Tax and Fee Administration. It's crucial to maintain accurate records and follow the appropriate procedures to request a refund.

Seeking California Sales Tax Help

If you have further questions or require assistance regarding California sales tax, it's advisable to consult with a tax professional or reach out to the California Department of Tax and Fee Administration. These resources can provide you with the guidance and support needed to ensure compliance with California's sales tax regulations.

Remember, understanding and accurately calculating California sales tax is crucial for businesses and individuals engaging in transactions within the state. Utilizing a California sales tax calculator and staying informed about the applicable rates and regulations will help you navigate the complexities of sales tax requirements in California.